This is the paragraph where you can write more details about this page.

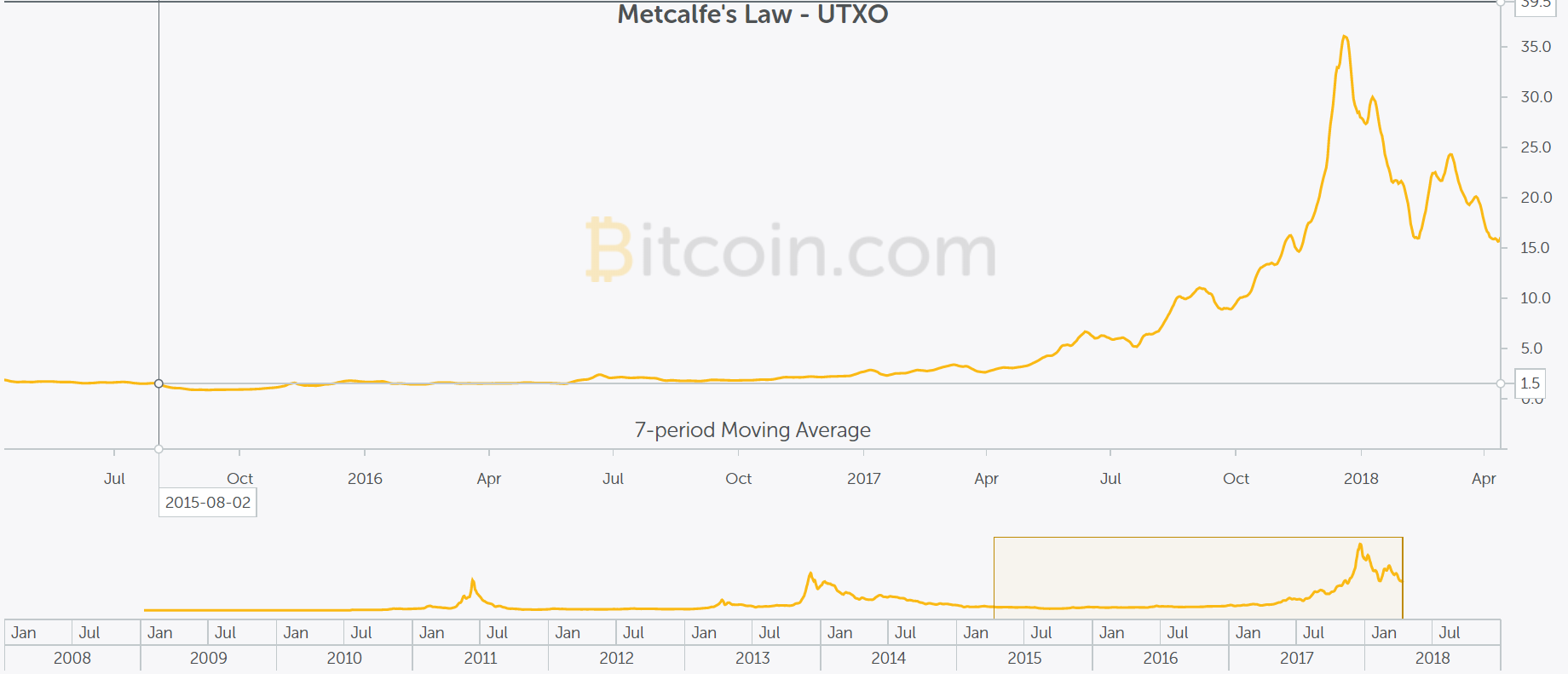

Bubble Index of the bitcoin

0 Received

The value determines the price, and the bitcoins has vaule only when people use it. The more people who use bitcoin, the higher value of bitcoin. the bitcoin which Only satoshi himself use is of no value, if all mankind use bitcoin , or the market capitalization of bitcoin will be the same as gold, gold market capitalisation divided by the $7 trillion to $21 million bitcoins, and 1bitcoin is 2 million dollars. and this why we often hear 1 bitcoin ,1 supercar.

For bitcoin fans, like me, it's easy to make money:

Buy when the price of bitcoin is below its value, and sell it when the bubble bursts.

So, what should we use to measure "bitcoin value"?

Metcalfe's Law :

Metcalfe's Law states that the value of a network is proportional to the square of the number of participants in the network.

This chart plots a variant of the Law in which price is divided by n log n of the number of unspent transaction outputs. Values are scaled by 106.

so, we know when to buy and when to sell bitcoin.

and the important thing is, we can also use it at BITCOIN CASH(BCH).

the matter is how to get these datas. you can find them from these websites:

https://blockchain.info/zh-cn/charts/n-unique-addresses?timespan=all&daysAverageString=7

https://charts.bitcoin.com/chart/metcalfe-utxo#5k4

https://bitinfocharts.com/comparison/marketcap-activeaddresses-bch-sma7.html

…………

please forgive my poor english……

BTW,It is really hard to explain it clearly here just by a photo……

For bitcoin fans, like me, it's easy to make money:

Buy when the price of bitcoin is below its value, and sell it when the bubble bursts.

So, what should we use to measure "bitcoin value"?

Metcalfe's Law :

Metcalfe's Law states that the value of a network is proportional to the square of the number of participants in the network.

This chart plots a variant of the Law in which price is divided by n log n of the number of unspent transaction outputs. Values are scaled by 106.

so, we know when to buy and when to sell bitcoin.

and the important thing is, we can also use it at BITCOIN CASH(BCH).

the matter is how to get these datas. you can find them from these websites:

https://blockchain.info/zh-cn/charts/n-unique-addresses?timespan=all&daysAverageString=7

https://charts.bitcoin.com/chart/metcalfe-utxo#5k4

https://bitinfocharts.com/comparison/marketcap-activeaddresses-bch-sma7.html

…………

please forgive my poor english……

BTW,It is really hard to explain it clearly here just by a photo……

Like this Pomp? Send some cheer!

(Send Bitcoin Cash to this address/QR code to cheer this Pomp!)

Bitcoin Cash address: 15vQzH5GYRxH4o4vNMLnM64jGcTB3ZMLaq

murder1983

murder1983